McKinsey Predicts a Tough 2025 for Luxury Brands

Why the luxury market faces a challenging year ahead.

Key takeaways:

Since 2016, it’s the first time the luxury market is expected to create less value than the previous year (except 2020).

Consumers are more interested in luxury experiences, not just luxury goods.

The luxury sector’s rapid growth caused overexposure, weakening exclusivity and creativity.

Fashion is experiencing a cyclical slowdown, and consumers are becoming price-sensitive from the recent period of high inflation.

The projected slowdown in growth underscores the need for luxury players to undertake a strategic reset.

The Deeper Dive:

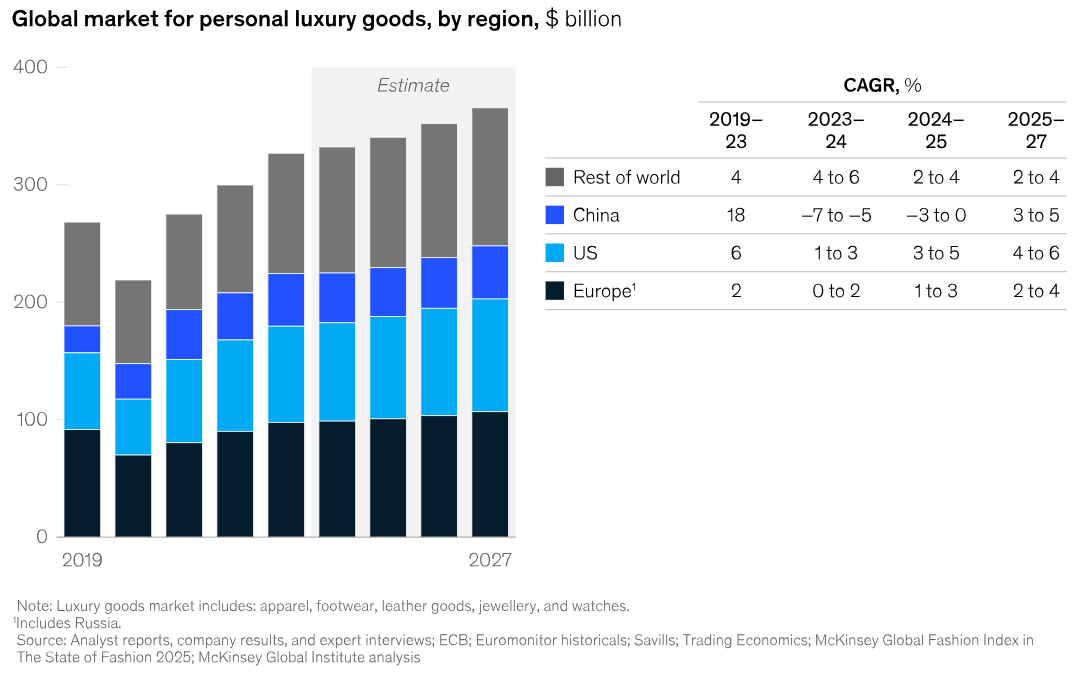

Over the past five years, the luxury market has seen significant growth and value creation, with megabrands like LVMH and Prada driving the sector to outperform global markets. Between 2019 and 2023, the industry achieved a 5% compound annual growth rate, largely fueled by price increases rather than volume expansion. According to McKinsey, price increases accounted for 80% of growth, while volume gains were more moderate.

McKinsey & Company chart: Economic Profit Trends in Luxury (2010 to 2024)

However, in 2025, the luxury and fashion industry is experiencing an anticipated cyclical slowdown, with the luxury sector expected to generate less value than the previous year for the first time in nearly a decade (excluding the pandemic-induced decline in 2020). This downturn reflects macroeconomic headwinds, pricing pressures, shifting consumer behaviors, and mounting challenges for luxury brands as they strive to adapt to an increasingly competitive and uncertain market landscape. In the annual McKinsey State of Fashion Executive Survey, only 20% of fashion leaders expect improvements in consumer sentiment, while 39% expect industry conditions to worsen.

When I say macroeconomic headwinds, I refer to the uncertainty surrounding consumer spending in China, which has historically been a major growth engine for the luxury market. Although China drove more than 18% growth from 2019 to 2023, brands are pivoting to other Asian markets, notably Japan, Korea, and India. In terms of pricing pressures, further price increases have hit their limit. Affected by the recent period of inflation, aspirational consumers have become increasingly price-sensitive. As a result, luxury players can no longer rely solely on price hikes to sustain revenue and must explore new strategies to maintain profitability and consumer engagement.

McKinsey & Company chart: Global Luxury Sector Growth (2019 to 2027)

In today’s market, customers are more interested in luxury experiences than just luxury products, especially among Millenials and Gen Z. This shift presents tradeoffs to customers as personal luxury goods brands now must compete against luxury travel and other high-end lifestyle choices to meet expectations and curate an immersive, personalized shopping experience. However, the sector’s rapid growth since 2019 has led to overexposure, contributing to a noticeable decline in creativity, exclusivity, and craftsmanship, weakening their core value propositions through strategies of frequent product drops and excessive brand collaborations.

How should luxury brands navigate this slow-growth environment?

In a climate of slow growth, the industry can use this environment to reflect and revise its long-term strategies. With consumers becoming more selective—especially after the recent inflationary period—brands must prioritize innovation, exclusivity, and deeper engagement to differentiate themselves. Here are McKinsey’s strategic imperatives for luxury executives to follow:

Conduct a strategic reset: clarify core values and align on priority clients to improve long-term strategy.

Restore product excellence.

Rethink client engagement strategy: develop unique “money can’t buy” experiences.

Attract, develop, and retain the best talent across every critical function.

Future-proof the portfolio: review exposure to different luxury categories and regions.

These steps offer a strong framework for long-term resilience, yet they understate how luxury brands are losing authenticity and connection to their origins. Reliance on aggressive price hikes often comes at the cost of exclusivity, craftsmanship, and heritage. While adapting to trends is crucial, brands must balance innovation with authenticity and brand history. I believe those who seamlessly blend modernity with legacy will stand out, ensuring consumer trust and lasting desirability.